How to invest sustainably in an unstable world?

Discover our program

-

Rhythm:Full time

-

Total duration:26 months maximum

-

Degree:Master of science - Grade Master, Visé BAC+5

-

Language(s):English

-

Format:Face-to-face

-

Campus:Paris Campus - Paris

-

Start Date:2025-09-01

-

Number of places:30

-

VAE accessible:No

-

Duration of internship / Work experience:4-6 months

-

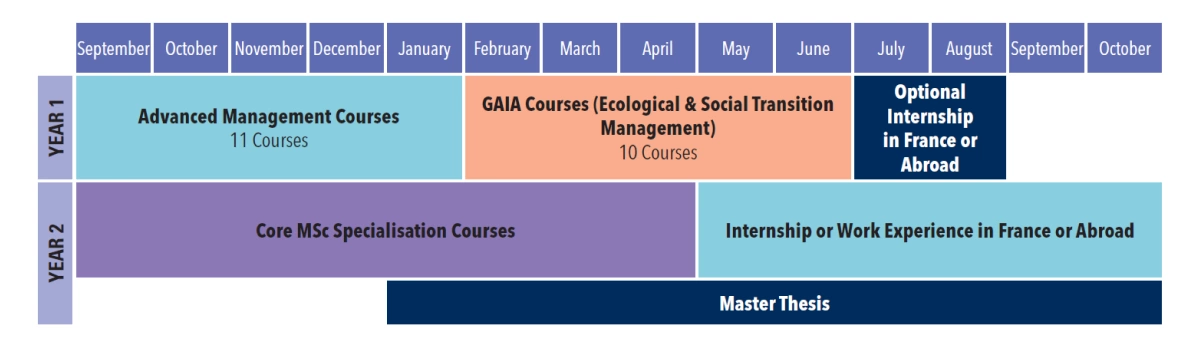

Training schedule:The 2-year MSc program offers a total of 465 hours of training

Program Benefits

A word from the Program Director

The MSc in Financial Markets & Sustainable Investments is a comprehensive finance program that integrates financial expertise with sustainability principles across economic and ESG dimensions. This program leverages Audencia's globally recognized expertise in sustainable management to enhance financial investments supported by artificial intelligence and econometric techniques. Audencia has indeed a track record of leadership in responsible business practices:

- It was the first higher education institution in France to sign the Global Compact in 2004.

- It played a significant role in defining the UN's Principles for Responsible Management Education in 2007.

- Currently, Audencia is pioneering new methods for measuring companies' performance to account for economic, social, and environmental outcomes in collaboration with multinational partners, including L'Oréal and PwC.